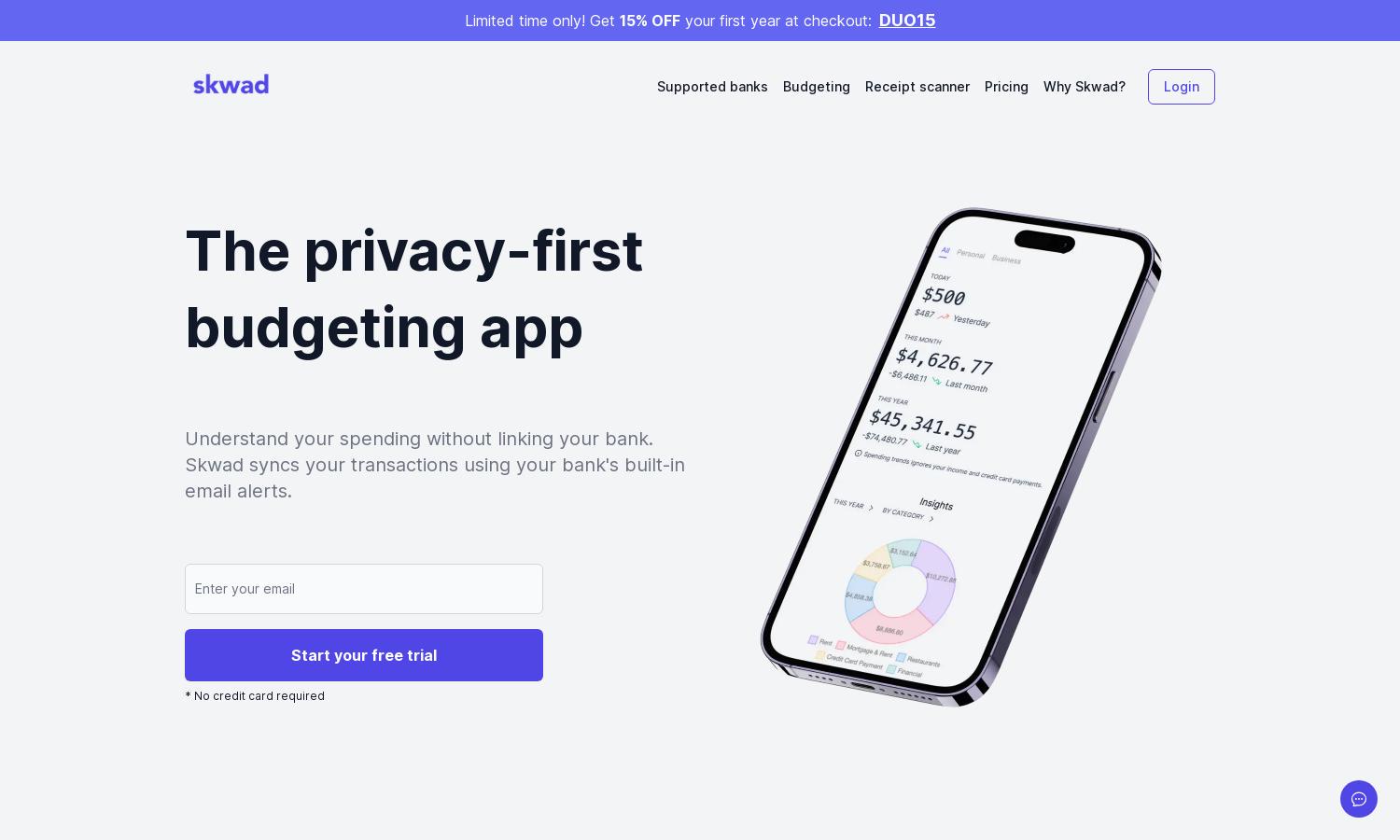

Skwad

About Skwad

Skwad offers a privacy-first approach to budgeting, allowing users to track spending without banking credentials. By utilizing bank email alerts, it automates transaction categorization, ensuring users maintain financial clarity and security. Ideal for anyone seeking a hassle-free and secure budgeting experience.

Skwad offers flexible pricing with multiple subscription plans, providing various features tailored to users’ needs. Starting with a free trial, users can access premium features at competitive rates, with a special discount available for the first year. Upgrading unlocks enhanced budgeting capabilities.

Skwad's user interface features a streamlined design that ensures a smooth budgeting experience. Its intuitive layout allows for easy navigation, with user-friendly tools like automatic categorization and receipt scanning, making financial management a breeze while users stay in control of their data.

How Skwad works

Upon signing up with Skwad, users receive a unique scan email address and set up alerts for bank transactions. By forwarding these alerts, users can let Skwad automatically categorize their transactions in real-time. This hassle-free setup allows for instant tracking of expenses and financial clarity.

Key Features for Skwad

Automated Transaction Syncing

Skwad’s automated transaction syncing feature revolutionizes budgeting by eliminating the need for manual bank logins. By using email alerts from banks, this innovative feature instantly categorizes transactions, saving users valuable time and effort while enhancing security and maintaining privacy.

Receipt Scanning

The receipt scanning feature in Skwad allows users to effortlessly track purchases by uploading images of their receipts. This unique functionality simplifies expense management, enabling users to categorize and analyze their spending patterns, all while maintaining privacy and security.

Customizable Expense Categories

Skwad offers fully customizable expense categories that empower users to tailor their budgeting experience. This feature allows for precise tracking of financial habits and preferences, enhancing user engagement and ensuring that financial goals are met more effectively.