Stocked AI

About Stocked AI

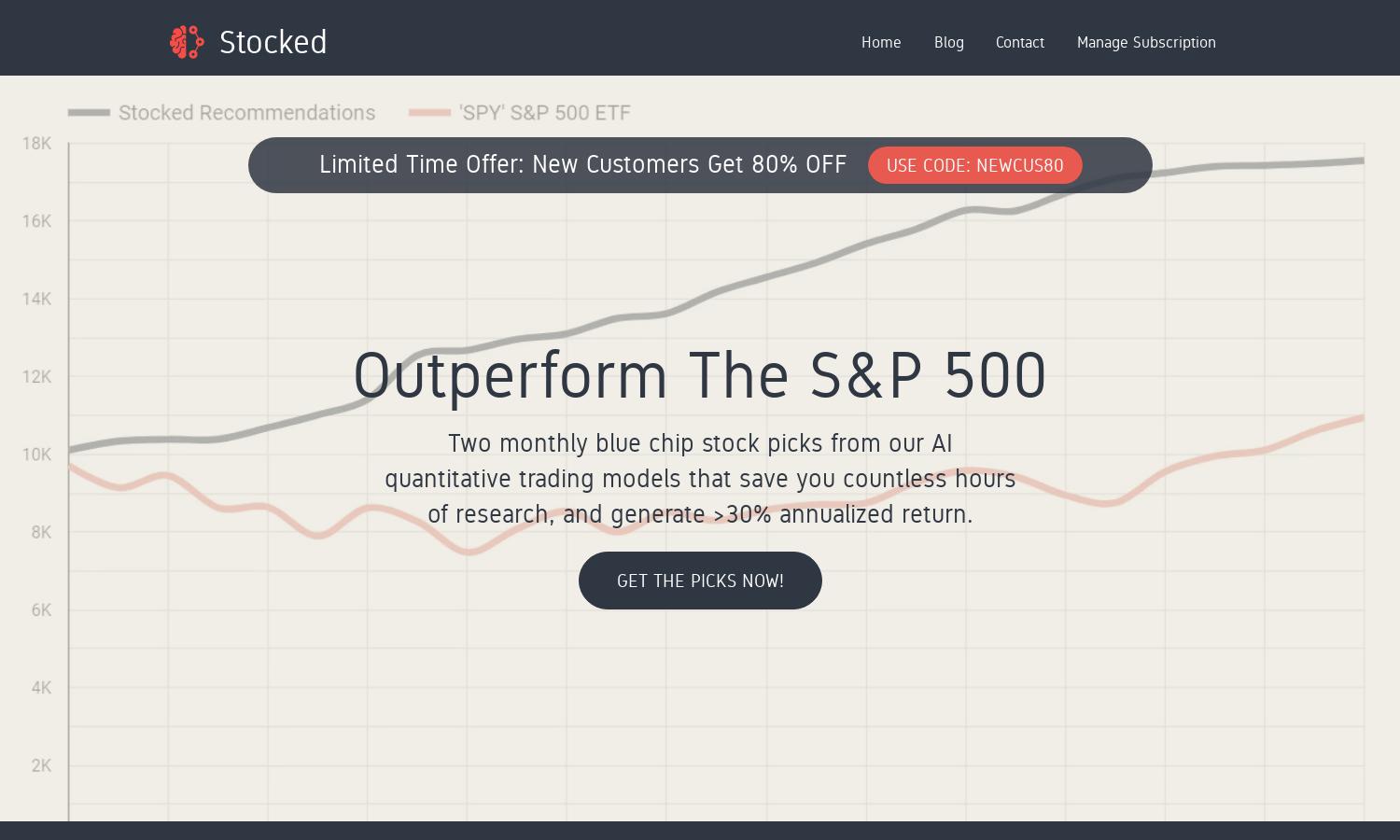

Stocked AI is an innovative investment platform designed for new investors seeking reliable stock recommendations. Utilizing advanced AI quantitative trading models, it analyzes data to identify high-potential stocks to help users grow their portfolios over time. This data-driven approach minimizes emotion-based decision-making.

Stocked AI offers subscription plans for users, including a monthly option at $29 and an annual plan at $295, providing significant savings. Each plan includes access to stock recommendations delivered via email, allowing users to make informed investment decisions and track performance effectively.

Stocked AI's user interface is designed for ease of navigation, featuring a clean layout that enhances the browsing experience. Users can access their stock recommendations effortlessly, and the well-organized content ensures that critical information about each recommendation is readily available.

How Stocked AI works

Users of Stocked AI start by subscribing to receive monthly stock recommendations via email. The platform's AI models analyze stocks in the S&P 500, selecting high-potential options based on extensive data analysis. The recommendations guide users in making investment decisions without personal bias, focusing on long-term growth.

Key Features for Stocked AI

AI-Driven Stock Analysis

The AI-driven stock analysis feature of Stocked AI utilizes advanced quantitative models to recommend stocks. The innovative approach helps investors make informed decisions by analyzing terabytes of data, focusing on high-potential stocks while minimizing emotional bias, ensuring better portfolio growth.

Monthly Stock Recommendations

Stocked AI provides users with two carefully selected stock recommendations each month. This feature allows investors to focus on growth opportunities without needing extensive market research, enabling them to follow a simplified, data-driven investment strategy that helps them achieve their financial goals.

User Portfolio Insights

Stocked AI offers users insights into their portfolio through detailed reports on past selection performance. This feature highlights investment success and aids users in adjusting strategies to align with market trends, offering both transparency and guidance for better financial decision-making.